Cybersecurity provider SentinelOne Inc. has engaged the services of an investment bank to explore the possibility of a sale, according to a report by Reuters today. The company is collaborating with Qatalyst Partners, a San Francisco-based bank renowned for its expertise in mergers and acquisitions, to “explore various options.” These options reportedly encompass potential sales to private equity firms.

Sources mentioned in the report indicate that SentinelOne is currently in talks with potential buyers. Despite this, the company has yet to receive an offer that aligns with its “valuation expectations.” It’s worth noting that SentinelOne might ultimately decide to discontinue the sale discussions.

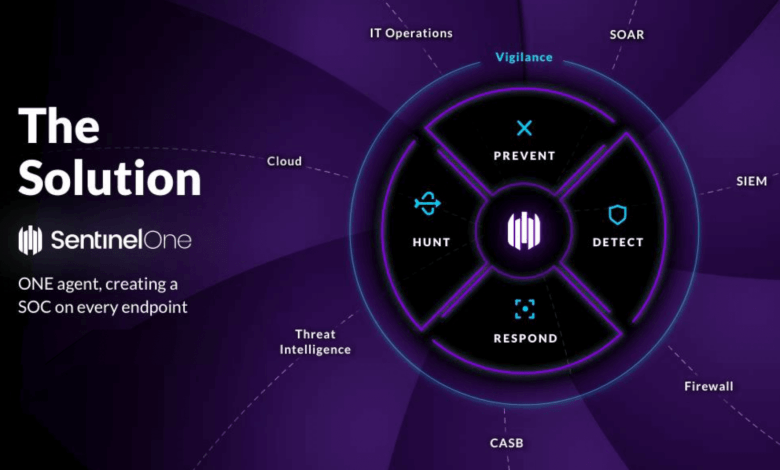

SentinelOne, listed on the NYSE, is recognized for its cybersecurity platform named Singularity. This platform plays a crucial role in safeguarding cloud workloads and employee devices from cyber threats. Furthermore, it can secure deployments of Active Directory, a Microsoft Corp. tool utilized by enterprises to manage employee access to business applications.

A notable feature of Singularity is its automation capabilities, aimed at streamlining administrative tasks. According to SentinelOne, the platform can autonomously identify all devices connected to a company’s network. Additionally, an integrated tool enables administrators to remove malware from a device with a single click.

Having gone public in June 2021, SentinelOne marked its trading debut with a valuation of $8.9 billion after raising $1.2 billion from investors. This valuation was nearly twice the amount attained by CrowdStrike Holdings Inc., a significant competitor in the cybersecurity sector, during its public offering two years earlier.

SentinelOne boasts that its Singularity platform served over 10,680 customers at the close of its latest quarter, reflecting a 43% increase from the previous year. Moreover, the number of companies investing a minimum of $100,000 annually in SentinelOne’s software surged by 61%.

The strong demand played a pivotal role in the company’s achievement of a 70% year-over-year increase in quarterly revenue, amounting to $133.4 million. Despite this, SentinelOne fell short of its revenue guidance, which had projected slightly higher sales of $137 million.

The company’s losses, on the other hand, widened and impacted its recent quarterly results. The net loss for the three months ending April 30 reached $106.86 million, compared to $89.83 million the previous year. Additionally, the company revised its annual recurring revenue data and lowered its full-year sales guidance.

Following the publication of its quarterly earnings report, SentinelOne’s shares experienced a decline of over 30%. However, investor optimism regarding the potential sale led to a partial recovery of those losses. The company’s stock concluded the trading session with a 16% increase.

Currently, SentinelOne holds a market capitalization of around $4.23 billion. Should the company’s reported intention to find a buyer materialize, the sale could become one of the cybersecurity industry’s most significant acquisitions this year. It would overshadow various other notable deals that have been finalized since January, including Thales SA’s recent acquisition of Imperva Inc. for $3.6 billion.

TagsSentinelOne Edit Post